Mining Indaba for Exploration and Junior Mining Companies

Connect with Investors at Mining Indaba 2026

Mining Indaba is the ultimate networking, deal-making, and discussion forum for the industry's current trends and challenges. This event offers unparalleled opportunities for junior mining companies and exploration mining companies to form connections, discuss project progression and explore financing opportunities. Additional value lies in gaining valuable insights into market trends, new technologies, and regulatory changes affecting the mining sector. Interested in attending Mining Indaba 2026?

Why attend Mining Indaba?

Meet Investors and Financiers

Mining Indaba is attended by a diverse array of investors, including private equity firms, sovereign wealth fund, institutional investors, automotives and high-net-worth individuals that are mandated to invest funds directly into mining companies. Through the Business Matchmaking platform, attendees can set-up meetings with investors and financiers to attract investment capital and explore financing options to support their growth initiatives.

Discover Networking Opportunities

You'll have access to dedicated networking events designed to help you:

Connect with investors actively seeking early-stage opportunities

Build visibility among major mining houses and policy influencers

Forge new partnerships to accelerate your next phase of growth

Whether you're looking to raise capital, promote a discovery, or position your project for the next stage, this is where conversations begin, and opportunities take shape.

Dedicated content themes

With the dedicated Investment Content Theme under the overarching theme of “Stronger together: Progress through partnerships”, Mining Indaba 2026, the event will delve into strengthening partnerships between governments, investors, and mining businesses, attracting investment, accelerating development, and improving efficiency, driving sustainable and profitable growth.

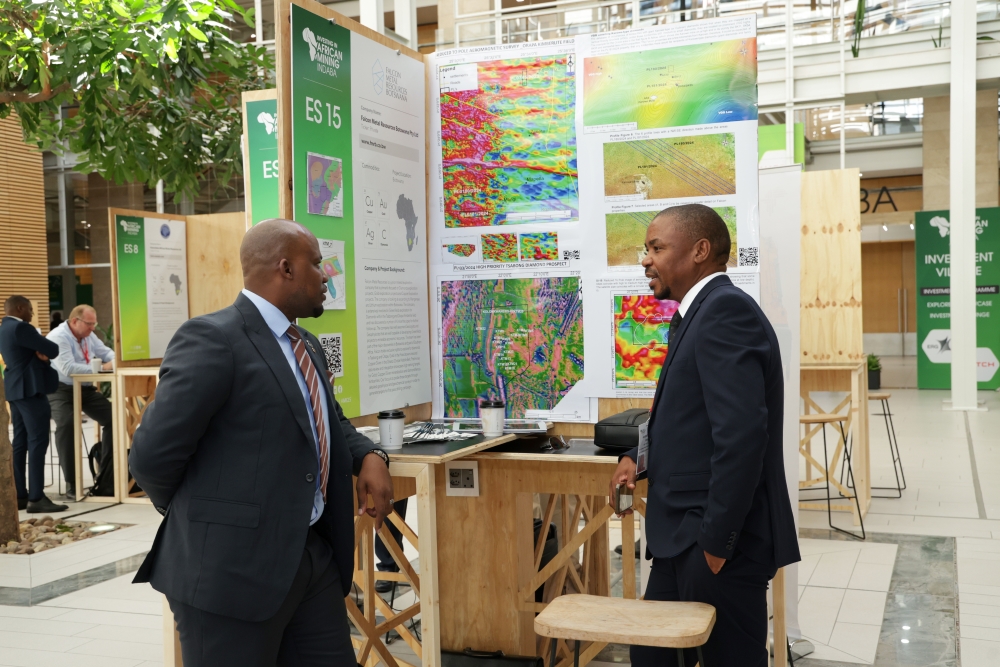

Junior and Explorer Showcases

Junior Mining Showcase

The Junior Mining Showcase, part of the Investment Village at Mining Indaba, is a dedicated space for junior mining companies with African assets to get enhanced visibility and direct access to investors, markets, and strategic partners.

Discover how it differs from the Explorers Showcase and supports junior miners in raising finance and advancing their projects.

Explorers Showcase

The Explorers Showcase is a space for early-stage exploration companies to showcase their assets and connect with top-tier investors and deal-makers to secure financing and strategic partnerships. Learn more about how it helps emerging mining companies spotlight their African projects and forge essential connections.

Spotlight Sessions for Exploration and Junior Mining Companies

2025 Attendee Testimonials

Head of Investor Relations Ankh Resources Ltd

VP - Business Development & Communications Midnight Sun Mining

COO Thor Explorations

Join Us at Mining Indaba 2026

Junior & Exploration Mining Companies

Who qualifies:

- Listed or private companies that hold valid exploration or mining licenses and engaged in prospecting, exploring, developing and/or or actively mining a natural resource deposit, excluding oil and gas.

- Actively seeking investment, JV partners or project development

What’s Included in Your Ticket?

300+ booths across two exhibition floors

1-on-1 meetings via Mining Indaba app with 10,000+ professionals

Official Monday Welcome Party

Daily happy hours at the Wine Farm and The Pit Stop

10+ stages with unique agendas and interactive workshops

Access to selected speaker sessions and reports after the event

Access to coffee and light refreshments and daily complimentary lunch

Daily printed Mining Pulse with event highlights and recaps covering key moments

£2670 £1570

Register Now

Top reasons why Juniors Attend Mining Indaba

Connect with capital. Discover opportunity. Drive growth.

Mining Indaba is where junior miners come to get deals moving. Whether you're looking to raise capital, attract new investors, or explore strategic partnerships and acquisitions, the opportunities are real and within reach. With direct access to financiers, industry leaders, and a global network of peers, it’s the place to tell your story—and take the next step in your journey.

Investor presence at Mining Indaba 2025

Investor interest in junior miners continues to grow, driven by the search for high-potential, early-stage projects with strong upside. Discover the depth of investor presence, where capital meets high-potential junior projects primed for growth.

Discover the Financial Powerhouses Who Attended Mining Indaba 2025

Mining Indaba 2025 attracted a powerful mix of financial players who drove investment conversations across the event. Institutional investors, private equity firms, asset managers, hedge funds, sovereign wealth funds, and royalty and streaming companies all played a key role in shaping the future of project funding and deal activity across the African mining landscape.

| Sector | 2025 |

|---|---|

|

Investment/Asset Management |

225 |

|

Corporate & Institutional Banking |

216 |

|

Investment Holding Company |

135 |

|

Development Finance Institution |

114 |

|

Private Equity |

88 |

|

Trading |

62 |

|

Family Office |

61 |

|

Other (Please specify) |

20 |

|

Qualified Private Investor |

20 |

|

Hedge fund |

19 |

|

Mining Company |

16 |

|

Royalty/Streaming |

15 |

|

Government Finance & Investment Agency |

14 |

|

Sovereign Wealth Fund |

13 |

|

Pension Fund |

6 |

What Caught Investor Attention: Top 15 Trending Commodities

At Mining Indaba 2025, investor interest centred around the commodities set to drive the next phase of global growth. Battery metals, critical minerals, gold, copper, and bulk commodities stood out as top priorities, reflecting momentum behind the energy transition, infrastructure expansion, and the push for more secure supply chains.

| Commodities | 2025 |

|---|---|

|

Copper |

824 |

|

Gold |

705 |

|

Lithium |

568 |

|

Manganese |

475 |

|

Iron ore |

464 |

|

Cobalt |

431 |

|

Nickel |

418 |

|

PGMs |

410 |

|

Rare Earths |

358 |

|

Zinc |

320 |

|

Coal (Thermal) |

292 |

|

Graphite/Graphene |

287 |

|

Coal (Metallurgical) |

276 |

|

Bauxite |

252 |

|

Silver |

251 |

|

Uranium |

246 |

Investment Size

nvestment Capital in Focus: Typical Deal Sizes at Mining Indaba 2025

The event revealed a broad spectrum of investment appetite, with capital deployed across exploration funding, mine development, and major project finance. Investors came to back deals ranging from early-stage ventures to multi-billion-dollar commitments, underscoring strong confidence in African mining’s long-term potential.

Featured Articles

South Africa’s MPRDA: Investor Confidence vs. Transformation

Everything you need to know about mining in SA’s Budget 2025

Winner: Dealmakers Den - Gold Category

Winner: Dealmakers Den - Critical Minerals Category

Improving Mining Permits in Africa: Transparency & Reform

Mintek Report Underscores South Africa's Critical Minerals Potential

Artisanal and Illegal Mining: A Question of Interpretation

Enhanced regional cooperation is required for effective ASM regulation

Voices of Africa - Driving Africa’s Industrial Renaissance with Tatenda Mungofa

Tanzania's emerging mining potential

Discover more Mining Indaba

Mining companies attending

Discover the list of mining companies that registered to attend Mining Indaba 2025.

BROWSE THE LISTExplorers Showcase

Explorers Showcase is a dedicated space for private/unlisted or listed exploration companies with African assets to showcase their projects at Mining Indaba.

LEARN MOREMeet the Advisory Board

Alongside the theme, we are honoured to introduce the distinguished members of our 2026 Advisory Board and Committees.

MEET THE BOARDFrequently asked questions

Mining Indaba is attended by the entire mining value chain, from investors to service providers, governments, and executives from major mining companies.

By attending, you will gain unique exposure to global investors, network with senior decision-makers, access critical industry insights, and receive tailored content focused on junior miners. It's a launchpad for partnerships, funding, and visibility.

Absolutely. Many investors attend Indaba looking for early-stage projects with high potential. Plus, it’s an excellent opportunity to build awareness, connect with the industry, find potential partners, and gather feedback from the market.

Register for your delegate pass as early as possible to take advantage of early-bird rates. Plan your itinerary and book accommodation to avoid disappointment.

Prepare a strong investment deck and print business cards (optional but helpful). Don't forget to download the Mining Indaba app to review the attendees list, schedule meetings with your target audience in advance, and attend happy hours and networking events.

The Mining Indaba app or web platform, which will be launched closer to the event, will allow you to see the list of attendees and schedule meetings with your target audience.

For any enquiries, please email [email protected].

You can take all your pre-schedule or ad-hoc meetings at the Business Matchmaking lounge, which is located in CTICC 2. Meetings with exhibitors also can be held at the exhibitor's booths in the exhibition hall.

.png?ext=.png)

.png?ext=.png)

.png?ext=.png)

.png?ext=.png)

_1.png?ext=.png)

-Logo_CMYK_1.jpg?width=1000&height=500&ext=.jpg)

.png?width=300&height=208&ext=.png)

_mi25-weblogo.png?ext=.png)

_1.png?ext=.png)

_logo.png?ext=.png)

_mi25-weblogo.png?ext=.png)