Mining Indaba for Majors & Mid-tiers

Showcase your brand to 10,500+ attendees at Mining Indaba: a must for mining companies in Africa

Mining Indaba enables direct engagement with African ministers, senior government officials, and industry leaders, providing a unique opportunity to discuss policy issues, regulatory changes, and legal frameworks impacting the mining sector. With exclusive access to the Investment Lounge, mining companies in Africa will also benefit from exciting networking opportunities. This event further provides a platform to deliver key messaging that enhances awareness and external perception, driving increased share value.

Why attend Mining Indaba?

Meet Government Officials

In 2025, Mining Indaba hosted over 58 Ministers and 1400+ government officials. The Indaba provides a unique opportunity to engage with government officials, regulators, and policymakers to discuss key policy issues, regulatory changes, and legal frameworks impacting the mining sector.

Explore the Exhibition Hall

The exhibition hall houses a vast number of service providers showcasing cutting-edge technologies, equipment, and services, aiming to provide an overview of how their services can enhance efficiency, productivity, safety, and sustainability of developing and operating mines.

Hear from Industry Leaders

Gain valuable intelligence and best practices from top mining executives, government officials, and industry leaders sharing their perspectives, strategies, and insights through thought-provoking panels, presentations and showcases.

Discover Networking Opportunities

Mining Indaba gathers a diverse array of global industry leaders from mining companies, national & international governments, and industry professionals for 4 days in Cape Town, hosting several dedicated networking receptions providing an unparalleled access for investors to network, forge new connections, and build fruitful relationships with key stakeholders.

Spotlight Sessions for Majors & Mid-tiers

2025 Attendee Testimonials

Investor presence at Mining Indaba 2025

Investor Interest by Mining Company Type at Mining Indaba 2025

Explore where investment is flowing across the mining value chain. From early-stage exploration to junior mining, mid-tier producers, and major mining companies, investors target diverse opportunities. Whether backing critical minerals, battery metals, or bulk commodities, these financial powerhouses in attendance fuel mine development, expansion projects, and strategic acquisitions across Africa.

Top reasons why Mid-tiers Attend Mining Indaba

Grow your network. Strengthen relationships. Stay ahead.

Mid-tier miners attend Mining Indaba to build new contacts, connect with existing clients and suppliers, and gain insights from the most pressing conversations. Whether you want to scale, optimise, or solidify your presence, Mining Indaba offers the right environment to engage, learn, and lead.

Top reasons why Majors Attend Mining Indaba

Lead the conversation. Elevate your brand. Shape the future.

For major mining companies, Mining Indaba is more than an event—it's a platform to amplify brand visibility, engage with key stakeholders, and stay ahead of industry trends. With unparalleled networking, rich content, and an influential audience, this is where majors show up to make an impact and drive the agenda.

Join Us at Mining Indaba 2026

Major & Mid-tier Mining Companies

Who qualifies:

- Listed or private companies that hold mining licenses and whose primary business is exploring, seeking to develop, or actively mining natural resource deposits, excluding oil and gas.

- Has multiple producing mines of various resources across different continents

Your ticket includes:

300+ booths across two exhibition floors

1-on-1 meetings via Mining Indaba app with 10,000+ professionals

Official Monday Welcome Party

Daily happy hours at the Wine Farm and The Pit Stop

10+ stages with unique agendas and interactive workshops

Access to selected speaker sessions and reports after the event

Access to coffee and light refreshments and daily complimentary lunch

Daily printed Mining Pulse with event highlights and recaps covering key moments

£2670 £2410

Register Now

Featured Articles

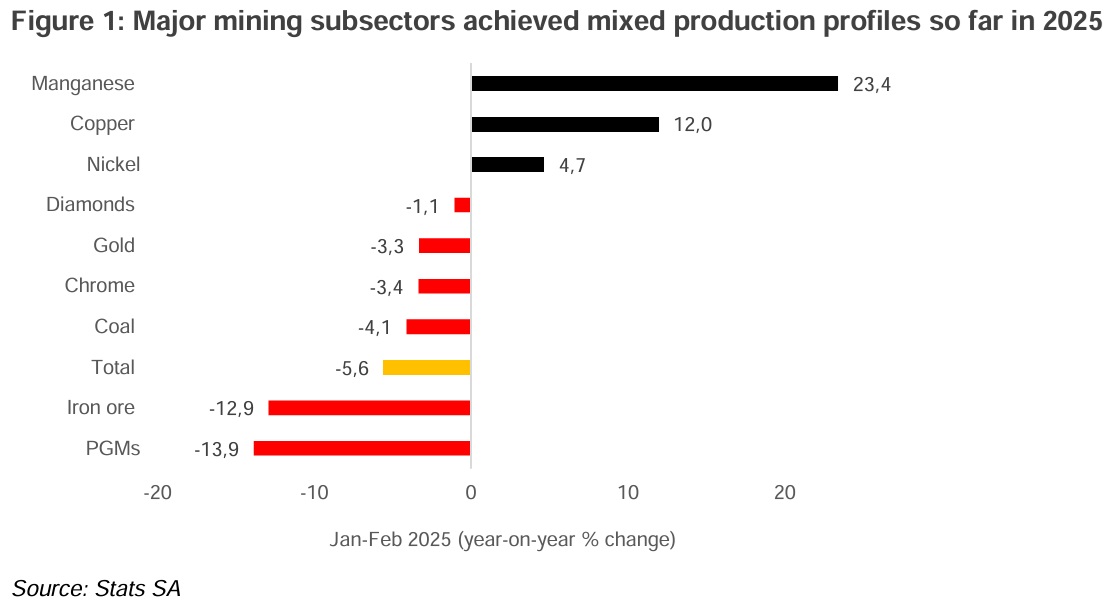

South Africa: Mining sector contraction in Q1 will be a hit to real GDP

South Africa’s MPRDA: Investor Confidence vs. Transformation

In Conversation with Minister of Mineral Resources, Petroleum and Gas, Angola

In Conversation with Minister of Mines and Mining Development, Zimbabwe

The tariff shockwave: What does Trump’s trade policy mean for Africa?

Ivanhoe Mines commences giant copper exploration programme

Prioritizing access to critical minerals will require prioritizing Africa

In Conversation with Minister of Natural Resources, Lesotho

Digital Diary with Marna Cloete, President of Ivanhoe Mines

MITV OnTheGround - Season 1 Episode 2: Inside the Control Centre Powering Autonomous

Green copper, vapour refining envisaged at Orion’s Northern Cape base metals mines

Frequently asked questions

You’ll meet heads of state, mining ministers, CEOs of global major and junior mining companies, institutional investors, and development banks, making it an ideal setting for high-level engagement and partnership development.

Executives from major mining companies can participate in keynote panels, leadership forums, ministerial roundtables, and strategic dialogues. Reach out to our content team via email [email protected] to explore speaking opportunities.

Executives can join closed-door leadership roundtables and engage with senior peers, including investors, government leaders, and downstream buyers.

Reach out to Natallia Zhuk from the sales team - [email protected] to see if we can help you accommodate it.

Mining Indaba's 2026 programming centres on key areas like critical minerals, communities & indigenous people, sustainability, downstream buyers, disruptive technologies, infrastructure & industrialisation, just energy transition, leadership, and governance & regulation. Mining company delegates will gain cutting-edge perspectives to plan their long-term strategic roadmap in Africa.

Yes. Many major companies bring cross-functional teams from exploration to procurement and investor relations to take full advantage of networking, supplier engagement, and technical discussions.

Register for your delegate pass as early as possible to take advantage of early-bird rates. Plan your itinerary and book accommodation to avoid disappointment.

Prepare a strong investment deck and print business cards (optional but helpful). Don't forget to download the Mining Indaba app to review the attendees list, schedule meetings with your target audience in advance, and attend happy hours and networking events.

Absolutely. The Ministerial Symposium (invite-only) and Intergovernmental Summit bring together African ministers, regulators, and policymakers to tackle permitting, downstream policies, and ESG standards, enabling direct access and influence.

With over 1,300 investors and curated offerings like Dealmakers Den and the Investment Village, there’s a focused emphasis on deal-making—especially around critical minerals and downstream opportunities—helping mining companies source capital & fast-track projects.

The event’s Sustainability Series, plus interactive sessions on energy transition, community development & indigenous people, and safety, embed ESG into all content streams across all of our stages—ensuring companies align with global best practices.

.png?ext=.png)

.png?ext=.png)

_2.JPG?width=400&height=400&ext=.jpg)

.jpg?ext=.jpg)

.png?ext=.png)

.png?ext=.png)

.png?ext=.png)

-Logo_CMYK_1.jpg?width=1000&height=500&ext=.jpg)

.png?width=300&height=208&ext=.png)

_mi25-weblogo.png?ext=.png)

_1.png?ext=.png)

_logo.png?ext=.png)

_mi25-weblogo.png?ext=.png)