Peter Major, Director, Mergence Corporate Solutions

|

With uncertainty in the African mining market, we sat down to speak with Peter Major, Director: Mining at Mergence Corporate Solutions. He gave us his take on the current challenges, PGM market, how wage negotiations are affecting investments, and where he’s seeing the biggest investments being made within the industry.

Your panel discussion at Mining Indaba 2020 is around the PGM market, can you give an insight as to where you see it heading?

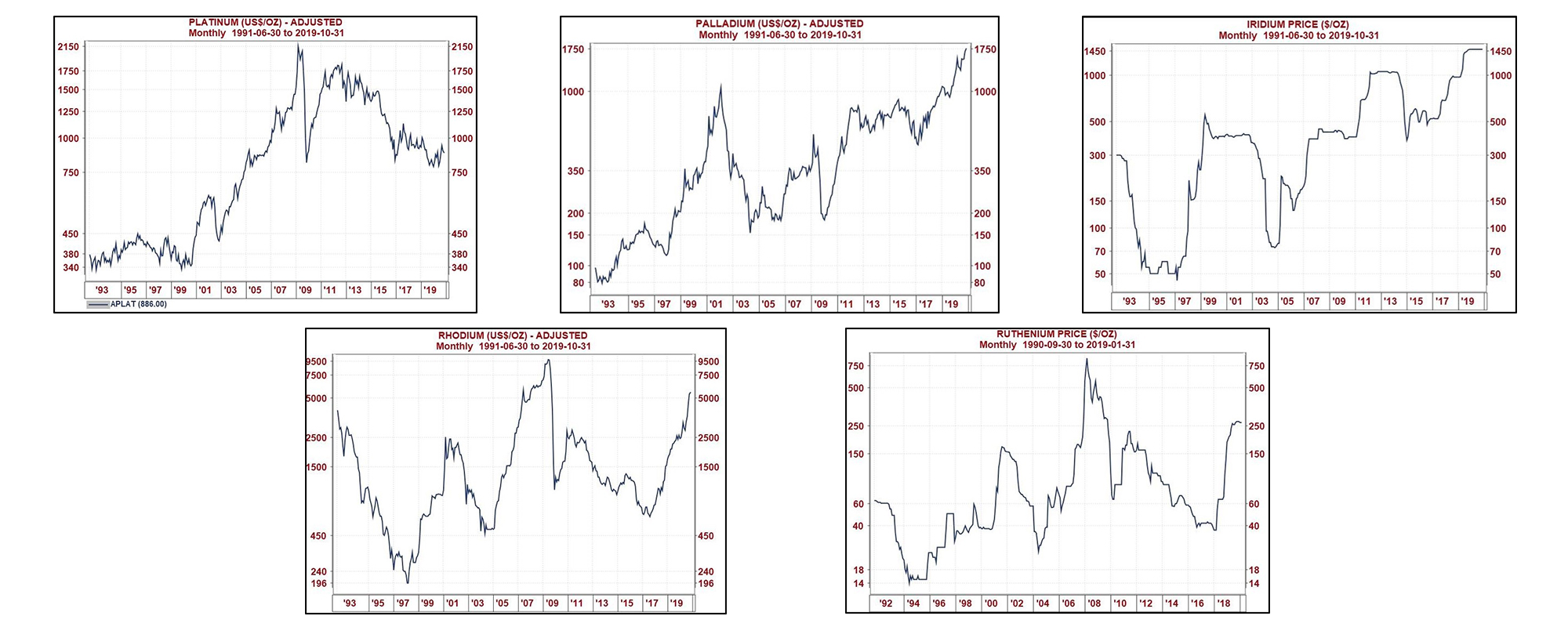

The Platinum Group Metals (PGMs) market is quite multifaceted and complex as each of the six PGMs (platinum, palladium, rhodium, ruthenium, iridium and osmium) have unique dynamics. The nice thing about this is that each components price can move separately from the rest, giving most producers good diversification and counterbalance to wild swings in individual PGM prices and production (see below for table 1). Overall PGM’s diversity is beneficial and helpful to producers and consumers alike.

What are you seeing as the current market challenges within African Mining?

In Africa, the answer is mainly - Legislation. Definitely in South Africa and increasingly in some of the other African countries. In South Africa, the major challenge is the Mineral and Petroleum Resources Development Act (MPRDA) which has now fully entrenched Mineral Nationalisation – 30% BEE giveaway/ scorecard/ entitlement – ‘legislation and thinking’ amongst all South Africa’s population. Now communities have joined unions and government in placing huge, unprecedented pressures on the industry and companies, ensuring that virtually every contract is given to a connected person or entity. The unions and ESKOM are as huge a challenge as ever before and worryingly, all these factors seem permanent and ever-growing.

Have you seen a certain increase as to what investors are looking for? And the types of projects that are being invested in?

YES! Investors want a certain guaranteed return within a visible and determined risk. They want to clearly see how the return is going to be achieved by each company they consider investing in. Demanding clarity on certainty and protection, with numerous high probability ways to see growth and dividends – as opposed to just growth – which too often doesn’t materialise or last. Investors want certainty that their interests are being considered and protected from government, communities, unions and management.

Wage talks bring uncertainty within the industry, is this a worry for investors due to the lack of clarity over the increases and if companies can absorb the costs?

Yes, with mere reassurances from management are not enough to quell concerns. Investors want to see mature, reasonable requests and actions from unions and governments in wage negotiations. They don’t want to see violence, demonization, unreasonable and inflammatory statements, let alone actions from any of the parties. More government participation and an unbiased, concerned and fair referee would go a long way to address these very important and legitimate concerns.

Have the wage negotiations affected investments being made within the PGM market?

Most definitely. No one wants to, nor should or nor will invest in an uncertain and hostile and worrying climate. It’s up to the main role players to craft an environment attractive to investors, the country’s future fortune – and disasters – are totally and completely in its own hands of the government, communities and unions.

Where are you seeing the biggest investments being made in African mining?

In existing operations where there is already some history and certainty. Brownfields is much more attractive than Greenfields and open-pit projects are much more attractive than underground which involves much more men, electricity/ Eskom. Investors want as little to do with underground workers and communities as possible. Thus – unfortunately – mining companies and investors are much happier funding destructive open-pit mines than higher grade - infinitely less destructive underground mines because of the problems that come with high manpower requirements, responsibilities and consequences.

Table 1.

-Logo_CMYK_1.jpg?width=1000&height=500&ext=.jpg)

.png?width=300&height=208&ext=.png)

_mi25-weblogo.png?ext=.png)

_1.png?ext=.png)

_logo.png?ext=.png)

_mi25-weblogo.png?ext=.png)