Lesotho is accelerating reforms in its mining sector, introducing new data systems, issuing exploration licenses, and pursuing regional collaboration to broaden its natural resources base beyond diamonds.

However, the sector is under pressure, with global market shifts weighing on production and employment.

Policy and regulatory developments

- The government is implementing a digital cadastral system to map mineral resources and make geological data globally accessible

- Mining laws are under review to make them more investor-friendly, including simplified licensing for artisanal and small-scale mining (ASM)

- Prospecting licenses are valid for two years, after which commercially viable projects may advance to a 10-year lease, allowing for government equity participation

- A national resource composition study is being planned to map untapped resources and expand investment opportunities, particularly in ASM

Exploration and discoveries

- Lesotho has issued its first coal exploration license. Early findings revealed the presence of rare earth minerals, commodities with higher value potential than coal

- Beyond diamonds, Lesotho holds prospective resources in shale gas, oil, copper, and gold, though these remain underexplored

Diamond sector outlook

- Diamonds account for around 8% of GDP, driven by production from four mines

- Lesotho’s diamonds remain among the world’s most valuable, sought after by luxury brands.

- Expansion to eight or ten mines could significantly raise GDP contribution, but volumes remain too small to sustain local beneficiation. Regional cooperation with Botswana and South Africa is being pursued to address this challenge

- Recent pressures are evident: the mining sector contracted by 5% in FY 2024/25 due to declining global diamond demand. At Letšeng Diamonds mine, between 250–300 employees face retrenchment as operations scale down, highlighting market volatility

Community and local participation

- The government has lowered barriers to entry for ASM licensing. Applications opened in 2025, with reviews underway

- Lesotho’s river systems offer opportunities for alluvial diamond mining, which requires relatively low capital investment

- Mining companies are expected to prioritize local hiring, subcontracting, and community development, including support for education, healthcare, and infrastructure

- Skills development remains a policy priority. The government has emphasized the need to realign education systems with mining and technical industry requirements to reduce dependence on foreign consultants

Regional and strategic collaboration

- Lesotho is working with South Africa, Botswana, and Zimbabwe to harmonize mining laws and retain more value from African resources

- Discussions with South Africa’s Minister of Mineral Resources and Energy continue around regional beneficiation frameworks

- In June 2025, Lesotho and South Africa signed agreements to boost trade and investment, including value chains in mining-linked sectors. At the Bi-National Commission, President Ramaphosa called for cooperation in mineral beneficiation, energy, and infrastructure development

- The government stresses that retaining resource value requires political will and coordinated regional strategies to discourage raw exports and encourage industrial investment.

More to come

The country is advancing the Lesotho–Botswana Water Transfer Scheme, a 700 km infrastructure project, positioning itself as a strategic supplier of water to the region. The 2025/26 national budget prioritizes economic diversification and private-sector development, though the mining sector is projected to remain under pressure in the near term. The World Bank’s April 2025 Economic Update urged Lesotho to strengthen private-sector-led growth, establish a stabilization fund for mining and water royalties, and accelerate export-oriented investment

Lesotho’s mining sector is undergoing reform and diversification, with progress in data systems, licensing, and regional integration. However, short-term pressures - including global diamond demand weakness and retrenchments at Letšeng - are constraining growth.

In the medium term, opportunities lie in rare earth exploration, ASM expansion, regional beneficiation initiatives, and water-energy projects. For investors, the sector offers a mix of high-value diamond production and early-stage diversification potential, framed by a government intent on modernizing the regulatory landscape.

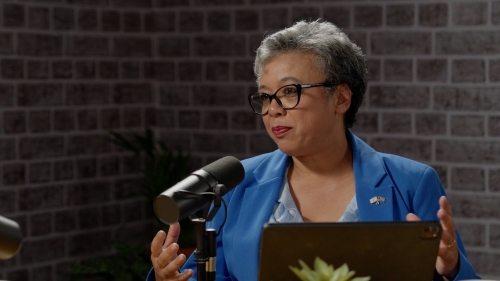

Watch: In conversation with Hon. Mohlomi Moleko, Minister of Natural Resources, Lesotho

-Logo_CMYK_1.jpg?width=1000&height=500&ext=.jpg)

.png?width=300&height=208&ext=.png)

_mi25-weblogo.png?ext=.png)

_1.png?ext=.png)

_logo.png?ext=.png)

_mi25-weblogo.png?ext=.png)